Effective Risk Management

The company establishes effective internal control and risk management systems with guidelines for compliance with relevant laws, standards, and policies. An independent internal audit unit is established to be responsible for developing and reviewing the effectiveness of internal control systems and significant risk management, while directly reporting the adequacy of internal control systems and risk management to the Audit Committee.

If the internal control and risk management systems are effective, they will help the company anticipate and manage economic, environmental, and social opportunities, as well as risks arising from the company's current and future business operations. Risk management is an important process that helps systematically plan for business uncertainties. The company adopts international standards as an operational framework to ensure that stakeholders understand risk management principles for development and application at all company levels, covering comprehensive management approaches for all company operations.

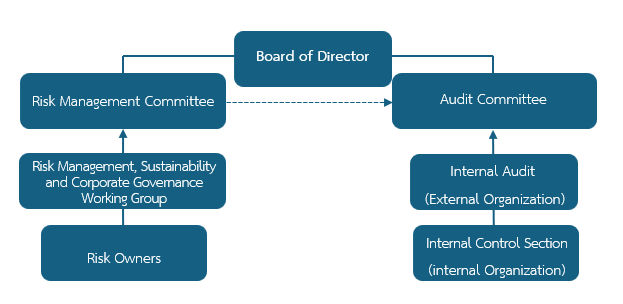

The Board of Directors has appointed a Risk Management Committee consisting of knowledgeable and expert members in operations and risk management, comprising 5 members. Their responsibilities include reviewing the risk management policy framework, risk management structure, and establishing a Risk Management, Sustainability and Corporate Governance Working Group ("Working Group") to work in parallel with the policy, as well as providing recommendations for risk management approaches that align with strategic operational direction and business plans, along with supervising, monitoring, and reviewing important risk management reports from all departments to ensure compliance with standards and changing environments. The Risk Management, Sustainability and Corporate Governance Working Group consists of members from various departments, with Ms. Shuleeporn Borrisuttanakul, Assistant Chief Financial Officer (Corporate Affairs), serving as the Working Group Chairman, responsible for the highest level of operational risk assessment and risk management. The company establishes a policy framework and risk management operational system that covers the entire organization's operations, following The Committee of Sponsoring Organizations of the Treadway Commission - Enterprise Risk Management (COSO-ERM) guidelines for organization-wide implementation, identifying and defining Key Risk Indicators (KRI) that may occur, including developing risk mitigation measures. Senior management considers and determines acceptable risk levels (Risk Appetite), supervises, monitors, and continuously reviews the risk management process.

The company establishes a policy framework and risk management operational system that covers the entire organization's operations, following The Committee of Sponsoring Organizations of the Treadway Commission - Enterprise Risk Management (COSO-ERM) guidelines for organization-wide implementation, identifying and defining Key Risk Indicators (KRI) that may occur, including developing risk mitigation measures. Senior management considers and determines acceptable risk levels (Risk Appetite), supervises, monitors, and continuously reviews the risk management process.

Additionally, the company has established an internal audit unit, which is independent of the risk management unit and reports directly to the Audit Committee. This unit is responsible for auditing and reviewing the organization's internal control systems and risk management systems to ensure that management is efficient and effective, as well as aligned with the company's guidelines. Audit results are reported to the Audit Committee and the Board of Directors for quarterly consideration of the adequacy and appropriateness of the organization's internal control systems.

The Audit Committee has appointed Owner Audit & Advisory Co., Ltd. to perform the company's internal audit functions. Owner Audit & Advisory Co., Ltd. has assigned Ms. Piyamas Ruangsangrob, Executive Director of Audit, as the primary person responsible for performing internal audit duties, with Ms. Tabtim Pimpakhan, Internal Control Supervisor, responsible for overseeing such work within the company.

Risk Management Results

- Creating Organization-wide Risk Culture: By providing training and education, establishing risk management as a performance indicator for risk-owning departments and employees at all levels. In the past year, 100% of directors, executives, and employees at all levels have completed training and review of risk management knowledge.

- Developing International Standard Risk Management Processes: Reviewing approaches and requirements for high efficiency with audits by both internal and external audit units.

- Conducting Risk Analysis and Management: By identifying risks, assessing, prioritizing, controlling, and monitoring by the Working Committee, management, Risk Management Committee, and reporting risk status to the Board of Directors every quarter.

- Establishing Key Risk Indicators (KRI): Considering internal and external factors to measure risk levels and promote timely adaptation.

- Continuously monitoring and reviewing risk management to ensure compliance with policies and effectiveness.

Strategic and Business Risks

1. Risk from Geopolitical Uncertainty (Emerging Risk)

Risk Characteristics:

Geopolitical conflicts in various regions worldwide, including the Russia-Ukraine war and conflicts in the Middle East, affecting global supply chains, crude oil prices, and plastic pellets.

Risk Impact:

1) Raw material shortages due to trade sanctions

2) Delays in raw material delivery due to extended transportation times

3) Delays in finished product delivery to customers

4) Volatility in raw material costs, especially plastic pellets

Risk Management Measures:

1) Coordinate with suppliers to find alternative raw material sourcing routes

2) Establish sub-production centers near customer locations

3) Consider creating appropriate reserve raw material warehouses

2. Risk from Strategy to Respond to Consumer Behavior Changes

Risk Characteristics:

Changing consumer behavior with trends toward reducing single-use packaging and increasing demand for environmentally friendly products.

Risk Impact:

1) Decreased sales of existing products

2) Loss of market share

3)Increased technology development costs

Risk Management Measures:

1) Implement Circular Economy strategy

2) Develop innovative, environmentally friendly products

3) Increase recycled plastic proportion

4) Develop biodegradable products

3. Risk from Limited Raw Material Supplier Dependence

Risk Characteristics:

Dependence on few and limited raw material suppliers may cause shortages in production processes.

Risk Impact:

1) Potential supply chain disruptions

2) Risk of raw material shortages

3) Reduced negotiating power

Risk Management Measures:

1) Diversify raw material sourcing

2) Make long-term contracts with suppliers

Find alternative raw material sources

4. Risk from Volatile Main Raw Material Prices

Risk Characteristics:

Fluctuations according to supply and demand of plastic pellets and crude oil prices in global markets.

Risk Impact:

1) Volatile production costs

2) Impact on product prices and profits

Risk Management Measures:

1) Closely analyze and monitor prices, reserve adequate raw materials for use

2) Negotiate with customers to adjust selling prices appropriately with changing plastic pellet costs

Management and Operational Risks

1. Risk from Inventory Deterioration

Risk Characteristics:

Delays in product sales, waiting for delivery to customers, including cases where customers request delivery delays.

Risk Impact:

1) Inventory age may cause product deterioration

2) Impact production costs used for those products

Risk Management Measures:

1) Plan inventory management, develop forecasting and stock control systems

2) Plan efficient and accurate sales

2. Risk from Cyber Threats

Risk Characteristics:

Potential theft of important or confidential information, or causing production system disruptions, affecting work or impacting customers/business partners.

Risk Impact:

1) Business continuity

2) Credibility, image and reputation

3) Trade information theft

Risk Management Measures:

1) Test and evaluate proactive defence plans against attacks

2) Practice cyber threat attack response plans and information system recovery plans

Financial Risks

Risk from Exchange Rate Fluctuations

Risk Characteristics:

Affects revenue and costs in foreign currencies.

Risk Impact:

1) Impact on group company operations

2) Impact on revenue and profits

3) Financial uncertainty

Risk Management Measures:

1) Enter into forward foreign exchange contracts

Regulatory and Legal Risks

Risk from Changes in Business Regulations and Laws

Risk Characteristics:

Enforcement of laws banning single-use shopping bags in major markets such as Thailand, United States, United Kingdom, Australia, etc., including environmental conservation policies and stricter environmental laws in trading partner countries.

Risk Impact:

1) Impact on revenue and decreased sales of existing products

2) Increased new product development costs

3) Challenges in adapting to different regulations in each country

Risk Management Measures:

1) Study laws and legal directions in existing customer areas

2) Seek new markets to replace declining sales

3) Develop new environmentally friendly products such as biodegradable plastics, products with recycled components

4) Invest in environmentally friendly production technology

Environmental, Social, and Governance (ESG) Related Risks

1. Risk from Climate Change (E)

Risk Characteristics:

Government push for businesses to reduce greenhouse gas emissions and stricter environmental laws in customer countries.

Risk Impact:

1) Costs of adjusting production processes to reduce greenhouse gas emissions

2) Risk from environmental measures in customer countries such as Carbon Border Adjustment Mechanism (CBAM)

3) Impact on competitiveness in foreign markets

Risk Management Measures:

1) Manage energy for maximum efficiency

2) Promote renewable energy use, consider innovation and environmentally friendly technology factors in investment decisions

3) Proceed with Carbon Footprint Product (CFP) certification and Carbon Footprint Reduction (CFR) labels

2. Risk from Community Acceptance (S)

Risk Characteristics:

Impact from business operations on communities and environment, and community growth in areas around factories.

Risk Impact:

1) Business operations causing environmental impact on communities

2) Risk to organizational image and reputation

3) Loss of Social License to Operate

Risk Management Measures:

1) Operate according to ISO 14001 Environmental Management System standards

2) Survey community opinions to listen to concerns and suggestions

3) Transparently disclose environmental operation information

3. Risk from Corruption (G)

Risk Characteristics:

Occurrence of fraud and corruption in business operations.

Risk Impact:

1) Revenue loss from fraud

2) Increased unnecessary expenses

3) Damage to reputation and credibility

4) Risk of prosecution both domestically and internationally

Risk Management Measures:

1) Prepare and communicate business ethics manuals to employees and partners

2) Establish anti-corruption policies and practices

3) Create transparent and auditable management structures

4) Increase safe fraud reporting channels

Business Continuity Plan (BCP)

To ensure the organization can maintain continuous operations even in crisis situations, the company has adopted business continuity management approaches, emphasizing strategic planning, work process improvement, and appropriate resource allocation. The company has prepared business continuity plans by developing practices consistent with internationally accepted business continuity management principles, covering the company's important operational areas, demonstrating commitment to emergency preparedness to build confidence among all stakeholders that the company can operate and deliver products even during crisis periods.

In 2024, the company conducted annual continuity plan drills simulating fire scenarios within buildings to test plan effectiveness and use findings to develop and improve work practices, focusing on quickly and efficiently restoring operations to normal conditions, not just fire evacuation drills, but covering continuity maintenance in all important work processes.