The Company's Board of Directors recognizes the importance of compliance with laws, objectives, regulations, and resolutions of shareholders' meetings. The Board adheres to and implements the Principles of Good Corporate Governance of Listed Companies as prescribed by the Stock Exchange of Thailand to serve as operational guidelines for the Company. This approach ensures operational efficiency, creates transparency for investors, and builds confidence in the Company's business operations among external parties. These principles are disseminated to directors, executives, employees, and stakeholders to serve as practical guidelines, with reference to the good corporate governance principles for listed companies.

The Company has announced and implemented a Code of Business Ethics and Work Conduct Guidelines, requiring all employees to undergo training and obtain annual certification in business ethics. There is continuous emphasis on proper compliance with laws, regulations, rules, and bylaws, particularly ethical standards. Therefore, it is a significant challenge for the Company to ensure that all employees strictly and completely apply good corporate governance principles to eliminate misconduct in their duties.

Another important challenge is establishing an efficient corporate governance system with effective governance processes and rigorous operational monitoring procedures. This involves integrating risk management information, laws, regulations, bylaws, and governance principles to ensure management achieves its objectives and builds trust among stakeholders.

Good Corporate Governance for TPBI Sustainability

TPBI has established a requirement to review and revise the Good Corporate Governance Manual, Code of Ethics, and Work Conduct Guidelines at least once annually. This review process is conducted through presentations by the Sustainability and Corporate Governance Committee to ensure the manual remains appropriate for current situations and business environments, and can be effectively implemented across the entire organization, including subsidiaries. This includes summary information regarding practices that have not yet been implemented by the Company, along with reasons and alternative measures.

Furthermore, the Company has communicated and disseminated these guidelines to the Board of Directors, management, and employees at all levels, requiring them to acknowledge and sign their commitment to use these as practical working guidelines for concrete implementation. These are also published on the Company's website and through internal communication channels.

Board Diversity Policy

The selection of directors must consider the benefits of diversity within the Company's Board of Directors in various aspects, including educational background, professional experience, skills, and knowledge, without limitation based on gender, age, race, nationality, religion, or any other differences.

Therefore, to align with the Company's policy, the director recruitment process has the following objectives:

- The Board of Directors should include at least one female director

- There should be no fewer than 3 independent directors, which represents no less than one-third of the total Board of Directors

- No limitations based on gender, age, race, nationality, or religion

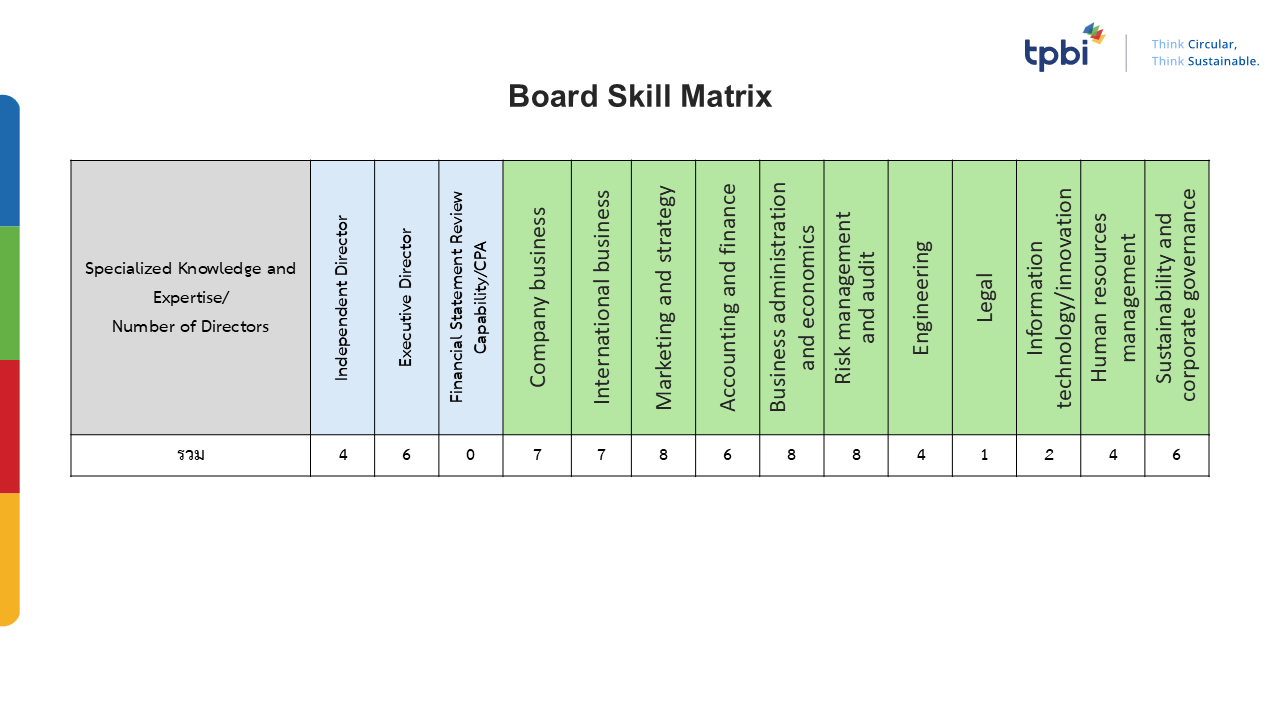

- Comprised of specialized knowledge and expertise (Skill Matrix) as follows:

- - Company business - International business

- Marketing and strategy - Accounting and finance

- Business administration and economics - Risk management and audit

- Engineering - Legal

- Information technology/innovation - Human resources management

- Sustainability and corporate governance

Results

Board Diversity: Male 9 persons, Female 1 person (10%)

|

Total Directors: 10 persons (100%) |

Board meeting 8 times |

|

Executive Director) 6 persons (60%) |

Average Board meeting attendance 100% |

|

Independent Directors 4 persons (40%) |

Board Diversity |

|

Non-executive directors and not independent directors - persons |

|

Board Responsibilities

The Company recognizes the importance of developing its corporate governance standards to be comparable with leading companies both domestically and internationally, which will contribute to the Company's sustainable growth. The Board of Directors therefore reviews the appropriateness and adequacy of the Company's corporate governance policies and business ethics practices annually to ensure alignment with evolving business models and environments, including laws, regulations, practices, and feedback from stakeholders.

In 2024

- The Board of Directors approved the 6th revision of the Good Corporate Governance Policy, which involved updating the duties and responsibilities of the Audit Committee to better align with good corporate governance principles and current circumstances. With unwavering commitment and determination to operate on the foundation of good corporate governance, the Company has consistently received excellent corporate governance ratings, achieving "Excellent" level or 5 symbols in the Corporate Governance Report (CGR) for listed companies for the 5th consecutive year in 2024.

- All directors serve continuous terms not exceeding 9 years from the date of their first appointment as directors.

- All directors hold directorships in no more than 5 listed companies combined (without exception) to ensure efficiency in performing their duties.

- The Company schedules Board meetings in advance for the entire year and notifies the Board of Directors before the end of the current year to allow for meeting planning. The Company holds meetings every 1st or 2nd Saturday of February, April (after AGM), May, August, November, and December, with additional special meetings as necessary.

- Clear meeting agendas are set in advance with regular agenda items for monitoring operational performance. The Company sends meeting invitations along with meeting agendas and supporting documents to all directors at least 5 days before the meeting date to provide the Board adequate time to study the information before attending the meeting, except in cases of urgent circumstances.

Information Disclosure and Transparency

The Company prepares Management Discussion and Analysis (MD&A) to accompany financial statement disclosures and produces newsletters to report quarterly operating results summaries, which are published through the Company's website. The Company also participates in Opportunity Day activities organized by the Stock Exchange of Thailand.

In 2024, the Company participated in Opportunity Day activities 2 times and published newsletters through the Company's website, with details as follows:

- March 6, 2024 - to report operating results for 2023

- August 28, 2024 - to report operating results for Q2/2024

Director Remuneration

ใAt the Annual General Meeting of Shareholders held on April 26, 2025, the director remuneration structure was revised as follows:

|

The Board of Directors |

Remuneration for the year (THB/year) |

||

|

1. |

Chairman of the Board of Directors |

1,200,000 |

|

|

2. |

Chairman of the Audit Committee |

280,000 |

|

|

3. |

Chairman of the Nomination and Remuneration Committee |

140,000 |

|

|

4. |

Chairman of the Sustainability and Corporate Governance Committee |

140,000 |

|

|

5. |

Independent Director |

330,000 |

|

|

6. |

Audit Committee |

200,000 |

|

|

7. |

Nomination and Remuneration Committee |

100,000 |

|

|

8. |

Sustainability and Corporate Governance Committee |

100,000 |

|

|

9. |

Director |

180,000 |

|

|

10. |

Attendance Fee for a Board Meeting |

||

|

- Chairman of the Board of Directors |

10,000 THB/Attendance |

||

|

- Independent Directors |

5,000 THB/Attendance |

||

|

Remark: |

|||

There is no other benefit to the directors except the remuneration of directors and bonuses. Executive directors do not receive bonuses as directors

Board Performance Evaluation

The Company conducts performance evaluations at least once a year, using the board performance evaluation guidelines from the Stock Exchange of Thailand. The Company Secretary distributes the board performance evaluation forms to the Board of Directors and sub-committees to assess both the collective performance of the board and individual self-assessments. The scores are then compiled and summarized for presentation to the Sustainability and Corporate Governance Committee and the Board of Directors, enabling the Board to review the evaluation results, identify problems and obstacles encountered during the past year, propose improvement recommendations, and utilize the evaluation results to enhance board effectiveness for optimal corporate governance going forward. The evaluation criteria are calculated as percentages of the total score, as follows:

90 – 100% = Excellent

76 – 89% = Very Good

66 – 75% = Good

50 – 65% = Satisfactory

Below 50% = Needs Improvement

Topics in the performance evaluation of individual directors as follows:

(1) Structure and qualifications of the Board of Directors

(2) Roles, duties, and responsibilities of the Board of Directors

(3) Board meetings

(4) Board's duties

(5) Relationship with the management

(6) Director development and executive development

(7) Results of corporate governance assessment by the Thai Institute of Directors Association

Topics in the performance evaluation of individual directors as follows:

(1) Structure and qualifications of the Board of Directors

(2) Board meetings

(3) Roles, duties, and responsibilities of the Board of Directors

For the performance results of the Board of Directors and sub-committees, as well as individual director evaluations for the overall year 2024, as follows:

|

Evaluation Results |

2024 |

|

|

Individual |

Board/Committee | |

|

ฺฺBoard of directors |

Very Good |

Very Good |

|

Audit Committee |

Excellent |

Excellent |

|

Nomination and Remuneration Committee |

Excellent |

Excellent |

|

Sustainability and Corporate Governance Committee |

Excellent |

Excellent |

|

Risk Management Committee |

Very Good |

Good |

Furthermore, the Board has provided additional comments and recommendations to improve the efficiency of the Board's performance for optimal corporate governance benefits.

Chief Executive Officer Performance Evaluation

The Board of Directors conducts an annual performance evaluation of the Chief Executive Officer at least once a year. The evaluation covers topics including leadership, strategic planning and implementation, financial planning and performance, relationship with the Board, external relations, management and personnel relations, succession planning, product and service knowledge, risk management and internal control, corporate governance, sustainability, and personal characteristics. The evaluation follows guidelines from the Stock Exchange of Thailand. In the evaluation process, the Company Secretary distributes the evaluation forms to independent directors or non-executive directors, or the Nomination and Remuneration Committee to conduct the performance assessment. The evaluation results are then discussed in the Board of Directors meeting (non-executive members).

For the overall performance results of the Chief Executive Officer for the year 2024, as follows:

|

Evaluation Results |

2024 |

|

Chief Executive Officer |

Excellent |

Succession Planning

The Company places importance on good corporate governance with sustainability and business continuity. The Board of Directors has therefore assigned the Nomination and Remuneration Committee to oversee the preparation of a succession plan for the Company's Chief Executive Officer and to periodically review such plan, considering various factors of executives who possess suitable qualifications, such as qualifications, knowledge, capabilities, experience, and periodic performance evaluations.\

The objective is to proactively plan for recruitment and selection of personnel in advance by planning and developing potential individuals within the organization for key positions to replace and succeed positions due to retirement or to retain talented individuals who may be targeted by external parties, reduce the loss of personnel with knowledge, capabilities, and experience, serve as motivation to retain capable and potential employees, while providing opportunities for development and promotion to higher positions, as follows:

- The Chief Executive Officer prepares the succession plan and presents it to the Nomination and Remuneration Committee for consideration and submission to the Board of Directors for approval

- The Nomination and Remuneration Committee monitors the progress of the succession plan, from identifying successors, developing potential, to performance evaluation

- When the position of the Company's Chief Executive Officer becomes vacant/unable to perform duties, the Nomination and Remuneration Committee is responsible for selecting a new Chief Executive Officer to present to the Board of Directors for consideration and approval of appointing a suitable person to hold the position

In 2024, the Company improved its management structure to be suitable for increasingly diverse business operations and to align with strategic plans for future growth. The Nomination and Remuneration Committee, in collaboration with the current Chief Executive Officer, considered defining the skills, knowledge, and capabilities for the Chief Executive Officer position to suit the organization. A succession plan was prepared by the Chief Executive Officer and presented to the Board of Directors (non-executive) and the Chairman of the Board for further consideration, with a development plan for high-potential executive groups and annual performance monitoring and evaluation.

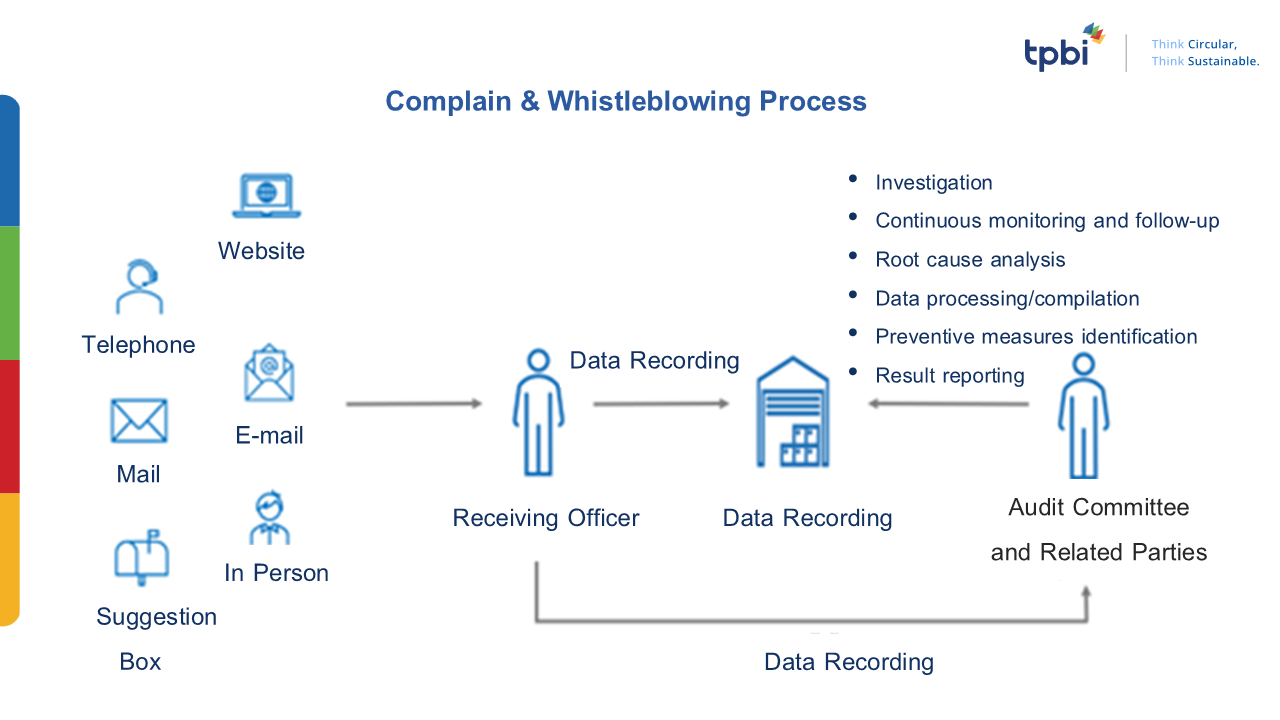

Whistleblowing System

In 2024, the Company monitored reports of whistleblowing or complaints through all 6 complaint channels and found that a total of 7 complaints were received, relating to products, services, and employee assistance, with no whistleblowing reports regarding fraud, corruption, or ethical misconduct. However, these complaint issues have been effectively resolved, demonstrating the Company's commitment to placing importance on good corporate governance with integrity, honesty, and ethics to enhance competitiveness and sustainable growth of the Company.

The Company continuously promotes transparent and auditable work practices and corporate governance. Complainants can inquire about details, file complaints, or report misconduct regarding legal violations, inaccuracies in financial reports, deficient internal control systems, or violations of the Company's business ethics through 6 channels: website, telephone, email, mail, and in person. The Investor Relations unit and Company Secretary are responsible for receiving opinions and various complaints from shareholders and investors, while management representatives and Human Resources are responsible for receiving opinions and grievances from employees. The Company has established clear procedures for handling complaints from shareholders, customers, employees, and other stakeholders to protect rights and preserve the privacy of complainants. Such complainants will receive protection and their personal information will be kept confidential, accessible only to relevant parties. In cases where there are complaints of potential misconduct, an investigation committee will be established, consisting of senior management and representatives from departments with no vested interest in the matter, to investigate and proceed according to the Company's disciplinary regulations and report to the Audit Committee and Board of Directors.

Whistleblowing Channels

|

|

In-person complaints at headquarters |

|

|

Written complaints sent to |

|

|

Telephone or fax complaints |

| Channel 4 | Company website www.tpbigroup.com |

| Channel 5 |

Audit Committee: |

| Channel 6 | Suggestion box for employees |